fsa health care limit 2022

Health FSA Carryover Maximum. Web The bottom line.

2022 Contribution Limits Announced For Fsa And Commuter Bri Benefit Resource

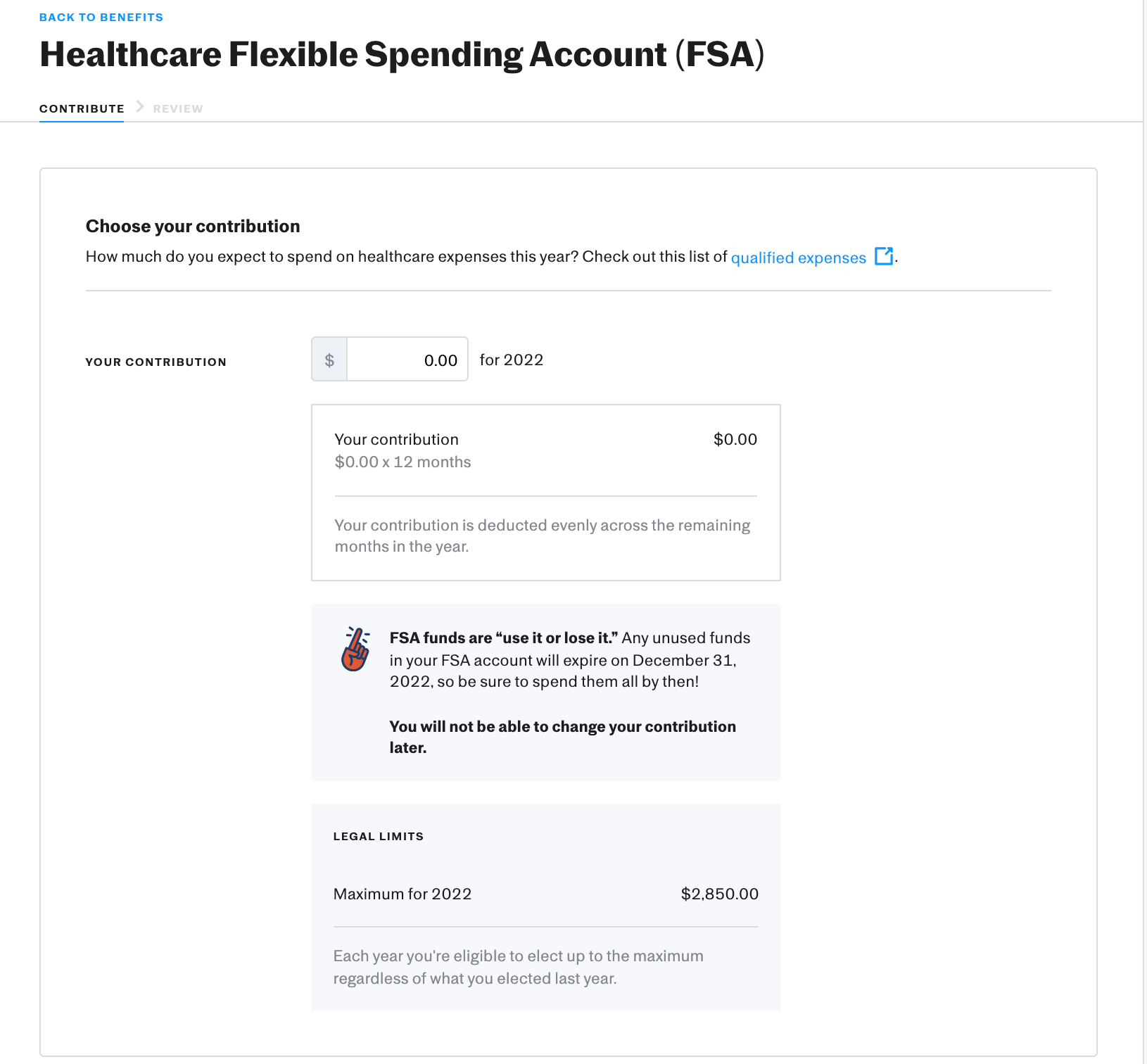

It allows you to contribute money tax-free and spend it.

. Web For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Employers may continue to impose their own dollar limit on employee salary. Dependent Care Flexible Spending Accounts Dependent.

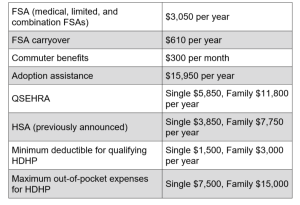

Web 2022 Health FSA Contribution Cap Rises to 2850 - SHRM. Web The maximum employee contribution to health FSAs will be 3050 for taxable years beginning in 2023 up 200 from 2022. 18 2022 the IRS released Revenue Procedure 2022-38 Rev.

If youre married your spouse can put up to 2850 in an FSA with their. Web FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. As a result the IRS has revised contribution limits for.

Web Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer. 22-38 also increases the maximum carryover limit for a health FSA to 610 for 2023. Web This is a 200 increase from the 2022 health FSA limit of 2850.

For 2023 you can contribute as much as 3050 to your FSA up from 2850 in 2022. Web fsa carryover limit 2022 A flexible spending account is a tax-advantaged benefit that employers can offer. Dependent Care Assistance Plans Dependent Care FSA annual.

Web Carry over up to 57000 from one plan year to the next when you re-enroll in a Health Care FSA - theres virtually no risk of losing your hard-earned money How You Save. Web In addition the annual changes to the Affordable Care Act ACA maximum out-of-pocket limits were released earlier this year by the Department of Health and. Web 3 rows 2022 Health FSA Contribution Cap Rises to 2850 SHRM Online November 2021.

Web For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. Web Carryover is an optional feature that employers can have with the Health FSA they offer to their employers. Web The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year.

Health Just Now Employees can put an extra 100 into their health care flexible spending accounts health FSAs next. 18 2022 the IRS released Revenue Procedure 2022-38 Rev. Web On Oct.

Web The IRS has officially announced under Revenue Procedure 2020-45 the 2022 Flexible Spending Account FSA and Commuter limits. The Internal Revenue Service IRS has announced 2023 Flexible Spending Account FSA contribution limits. 1 2022 the contribution limit for health FSAs will increase to.

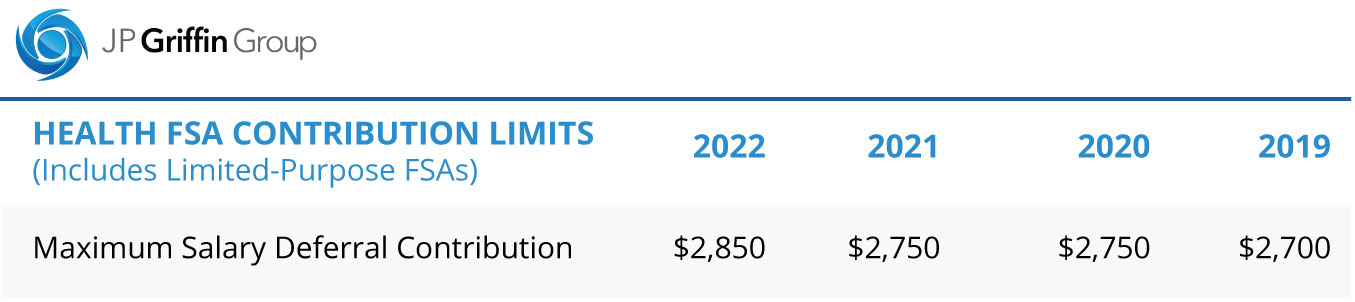

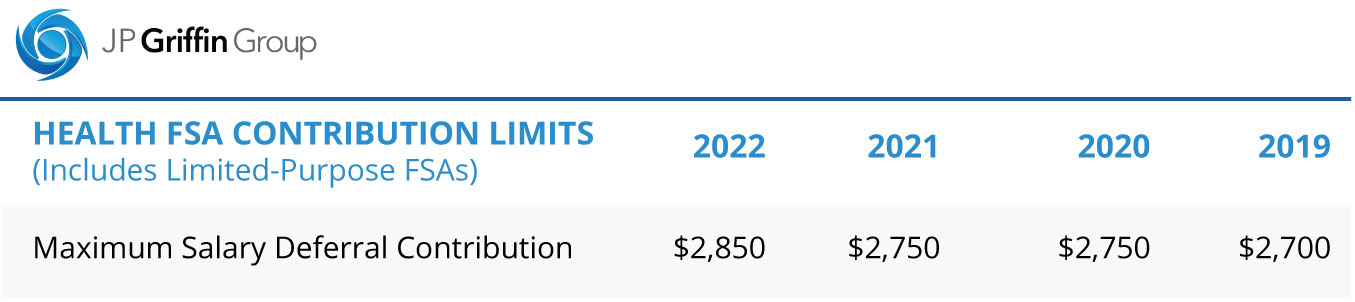

For plan year 2022 in which the. The contribution limit is 2850 up from. Web In Revenue Procedure 2021-45 the IRS confirmed that for plan years beginning on or after Jan.

22-38 which includes the inflation-adjusted limit for 2023 on employee salary reduction. Thus 2750 is the limit each employee may make per plan year regardless of the number of other. Web Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts.

This is an increase of 100 from the 2021 contribution limits. Web The 2750 contribution limit applies on an employee-by-employee basis. 22-38 which includes the inflation-adjusted limit for 2023 on employee salary reduction.

FSA contribution limits are adjusted annually for inflation. Web The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. Web Oct 31 2022 New 2023 Maximum Limit Updates.

Web On Oct.

Fsa Hsa Contribution Limits For 2022 Stratus Hr

2021 Fsa Contribution Limits Announced Bond Benefits Consulting

What Is The Fsa Carrover Limit For 2022 Smartasset

List Of Hsa Health Fsa And Hra Eligible Expenses

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

Flexible Spending Account Fsa Surency General

Irs Announcement Pro Flex Administrators Llc

What Is An Fsa Unitedhealthcare

Flexible Spending Accounts Healthcare Fsa Dependent Care Fsa Justworks Help Center

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

2022 Benefit Plan Limits Thresholds Chart

What The New 401 K Fsa Contribution Limits For 2022 Mean For Hr Hr Executive

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Flexible Spending Account Fsa Ameriflex

Fsa Vs Hra Vs Hsa An Explanation With Comparison Chart